The European startup ecosystem comes of age

Since the '60s Silicon Valley has acted as the epicentre of innovation for startups across the globe home to the world’s largest technology companies and an established asset class of venture capital which has served as it’s driving force. As an ecosystem, it has had the equivalent of a multi-decade monopoly and head start on other geographies which continues to compound sitting on top of the global startup ranks decades later.

I often think of Y Combinator as a symbol of the success the US has experienced with startups and a yet to be replicated jewel of any other ecosystem taking global talent from across the world and producing 100 companies valued at over 150 million USD and 19 companies valued at over 1 billion USD.

These are the top @ycombinator companies of all time, based on valuation #startups #venturecapital

— Jose E. Puente (@jepuente_telco) October 3, 2019

1. Stripe

2. Airbnb

3. Cruise

4. DoorDash

5. Coinbase

6. Instacart

7. Dropbox

8. Ginkgo Bioworks

9. Gusto

10. Flexporthttps://t.co/S9yc64ZkQF

If Y Combinator is to Silicon Valley what Silicon Valley is to the rest of the world, nowhere else has this feat been emulated so consistently in a single entity but the tides are changing and this super hub model is evolving to a globally distributed one with different blueprints being adopted around the globe from the government-driven Chinese approach to the corporate-driven one made dominant by the USA.

It is clear that both approaches are working with China and the USA now home to 80% of the world's 206 Unicorns and 75% market share of all venture capital invested. However, what is most impressive is the timeframe in which China has been able to achieve this only eclipsing Europe as a destination for venture capital a mere 6 years ago. Up until 2014, both regions had similar patterns of investment and growth but that has shifted by orders of magnitude recently with China investing 294 billion USD and Europe only 105 billion USD over the same timeframe.

Comparison is the thief of joy and the answer to Europe's challenge is not as simple as increasing the amount of venture capital available nor Europe becoming a China or USA clone but it begs the question just what is the approach of Europe; how do we plan to compete globally and when will we hit escape velocity?

The potential of Europe

Europe presents a huge opportunity with the largest economy in the world with a GDP per head of 25,000 EUR for its 500 million consumers. Moreover, its countries are of the most sophisticated in the world with internet commerce as a % of GDP the highest globally in markets like the UK at 13%. This scale translates to sizable trade relationships serving as the world's largest trader of manufactured goods and services and a top trading partner to 80 countries vs the USA mere 20 countries. Europe also dominates the global innovation index with 8/10 countries (incl Israel) placing in the top 10.

So, looking at Europe with all of its potential, it seems illogical that it receives just 20% of venture capital compared to our friends across the Atlantic but it isn't as binary as venture capital received. The challenge is more of a structural problem in converting the scale and potential of Europe to a homogenous border-free market for technology companies to create increasing returns to scale in a single favorable regulatory market for startups. I'll reflect on some broken windows that need fixing in Europe later but first want to touch on how the pendulum is beginning to swing in Europe's favor.

1. There is abundant smart institutional capital

There is more capital available in Europe than ever before for entrepreneurs. Analyzing 2019 data European growth in institutional venture capital continues to grow at 41% YoY vs decreases in Asia and USA of 2% and 47% respectively. Europe is also creating super scalers on the path to Unicorn status with 50+ 100M rounds and 6 rounds of 500M+.

5 years ago these milestones were unattainable for Europe but the funding gap is now rapidly closing to the point it is a function of global ranking vs entrepreneur availability with abundant smart institutional capital available. Moreover, the experience of that capital is compounding with funds now on their 7th or 8th + fund building out dedicated operator-driven teams to support entrepreneurs as they move through the venture lifecycle.

Analyzing data from Dealroom it estimates there are 3,000 VC funds in Europe and these funds are able to compete at every stage from Seed - Series D with Atomico counting 2,604 unique investors participating in a venture round in 2019.

2. US and Chinese investors are courting European entrepreneurs

It’s the worst kept secret in London that US firms are scoping out expansion to Europe and going by their increased investment activity the gauntlet has been thrown down by US investors. Europe has yet to see Investors compete aggressively at an early stage with all seed and Series A investments comfortably owned by European investors. However, looking at later stage funding we can see that 90% of all deals > 100M USD involved an American or Chinese investor.

Amazed people aren’t talking about this more.

— Harry Stebbings (@HarryStebbings) September 26, 2019

Valley VCs are coming to Europe en masse.

Why:

💵 Better pricing

💻 High quality engineers: fraction of SF cost.

👨👨👦👦 Competition: divided by 4.

🌍 Europe doesn’t want to sell for $100m anymore, we have global ambitions.

VCs are catching on that Europe presents a tangible opportunity on multiple levels around geographic portfolio diversification, culturally lower valuations and increased ROI. Looking at 2019 large investments from Kleiner Perkins in Evervault, Y Combinator in Monzo, Softbank in OakNorth its clear that US VCs are winning cap tables at every stage from A - D and indicating a willingness to invest in the early-stage European ecosystem where overall 20% of funding rounds included a US investor.

From the vantage point of startup founders it’s also a compelling proposition where US VCs possess a clear advantage on go-to-market best practices and networks for US expansion and the ultimate pinnacle of all for founders; how to IPO successfully. For regional ecosystems, the long-term consequences of this are not clear.

The problem is that when increased ownership shifts overseas so too does the propensity for future geographic investment and the second-order effects expected from achieving exit velocity locally both at VC and startup level. This will be a watch-point and increasing point of contention for European VCs over the next decade.

3. Smart founders are going the distance in Europe

Historically Europe has suffered from stigma on selling out early for pre-mature exits due to M&A from large US tech companies, specific examples of companies like Deep Mind, Bloomsbury AI or Magic Pony Technologies being acquired by Google, Facebook and Twitter. However, this phenomenon is decelerating with many founders now going the distance in later stage rounds on what is typically the main signal for IPO which is exactly the medicine Europe needs.

This persistence is beginning to yield dividends for the European ecosystem creating exit value of $107 billion in 2018 almost exceeding US exit-value. Most importantly these exits are triggering second-order effects and compounding with second-time entrepreneurs tackling big categories with ex-Monzo, ex-Skyscanner, ex-Deliveroo, ex-Draft Kings, ex-Revolut, ex-King teams and more launching startups in the last year.

Huge potential for second-order effects. IPO will free people to start their own company or invest. It will also provide a playbook for starting cos in Europe (dev in a cheaper city > move to US when there is deep PMF). On top of the inspiration to the next gen of founders.

— Victor (@Victor_Patru) September 11, 2019

Successful liquidity events for Europes leading scale-ups like Improbable, Deliveroo, Monzo, Revolut, N26. Graphcore, LetGo, Dark Trace and more will be crucial in creating rejuvenation.

Europe is starting to deliver on its promise of becoming a Unicorn machine and will very shortly hit 100 unicorns with key competencies in fintech and enterprise SaaS and deep tech maturing as a business model in the background. The salient point is that these companies are distributed across Europe with over 20 unique countries creating a Unicorn including emerging ecosystems like Romania, Poland, Austria and the Czech Republic. Most importantly these companies are not being acquired, the vast majority of Unicorns created during the 2010s are still private and going the distance.

4. Diverse ecosystems are Europes strength

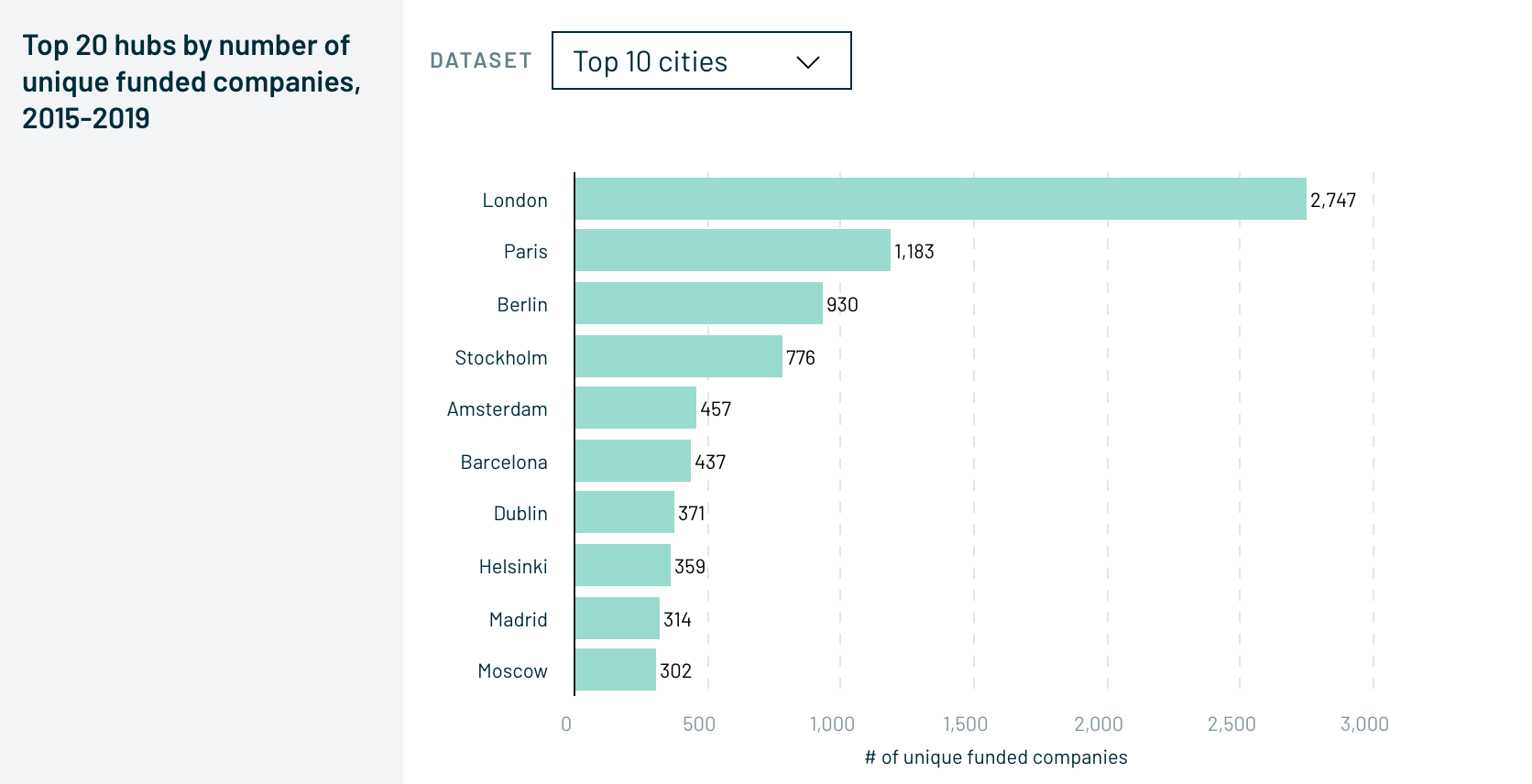

The old story of Europe was a small group of dominant cities with a monopoly on the digital transformation of Europe; namely London, Stockholm, Berlin, and Paris. That picture has transformed since 2016 to create self-sustaining, vibrant ecosystems across all of Europe not dependent on super-cities and countless ecosystems emerging across Europe.

France is now almost at parity with the UK for early-stage investment with upcoming hubs including Cluj-Napoca, Tallinn, Barcelona, Dublin, Lisbon, Minsk. Equally these communities are the most active startup communities globally with over 170 cities in Europe hosting 100+ tech-related meetups and London leading all other cities in Europe with meet-up activity at 2x Berlin.

What I am most interested in is the future growth of emerging hubs in Europe which are largely under-invested in. This is where all of the growth is coming from at community and talent level, similar to the rise of the top 4 of London, Paris, Stockholm, and Berlin in the early 2010s. The top growing countries at community level are all CEE based the majority of which sit outside the top 20 geographies in Europe for investment in 2019 so are clear growth markets.

It’s crazy how CEE founders (esp. Romania, Ukraine & Poland) unbundle their companies geographically.

— Hugo Amsellem (@HugoAmsellem) October 24, 2019

- Hire in their home country

- Incorporate in Delaware

- Fundraise in the US

- Sell to the whole world

- Pretend they live in SF/NYC

e.g. @Grammarly, @UIPath, @brainly, etc.

It’s also possible to spot the same trends looking at the intersection of developer talent and capital invested in these countries. The UK is by orders of magnitude very mature, future development in the UK will be slow incremental growth but Germany, France, Russia and CEE present all the markers of outsized growth potential as these talent hubs start to receive more capital.

On the whole, Europe has more developers than the USA, it is unrivaled in talent density with 6.1M developers as compared to 4.1M in the USA which has been flat for the last two years. Moreover, there are more developers in London than there are in NYC whilst the top computer science schools of the world are in Europe with 4/10 listing in the global ranks every year.

London still reigns supreme as a stomping ground for high-potential VC-backed startups (producing more than any other city) with the need to incubate developer talent centrally but is increasingly being challenged by new cities like Berlin and Paris attracting remote startups and lean teams who do not need or desire the London blueprint for growth.

5. Brussels is still underinvested in the startup economy

Lack of innovation in governmental frameworks is a significant barrier to a homogenous market in Europe. There are early symptoms of the environment changing in this regard with the introduction of a €100 billion EU Commission future fund to back sectors across the EU where the region is a laggard globally. The European Commission and the European Investment Fund also announced a €1.6 billion VC fund-of-funds program to increase fund sizes and lure in larger institutional investors to the European market.

Startup-friendly environments exist in different guises across Europe from the SEIS-EIS tax breaks for investors to back entrepreneurs in the UK to Macron’s €5 billion startup fund and an advanced regulatory environment for startups in Estonia but the structural problem of Europe still exists. Much is to be done in delivering on the promise of the single-market and enabling true cross-border relationships. The biggest lever at the disposal of the European Union is in finding a way to reduce (or eliminate) the friction borders create as this still presents multiple regulatory hurdles for startups launching in new EU countries, multiple incorporations, and multiple go-to-market approaches.

Fixing broken windows in Europe

It is clear Europe presents so much potential and is starting to deliver on its promise but there are challenges and broken windows to fix which are holding Europe back and enabling other regions to accelerate and compound; namely funding, policy and fragmentation.

1. Take VC to the next level as an established and available asset class

Venture capital has accelerated dramatically in Europe over the last decade but it is still lagging behind compared to the USA and Asia. A key driver of this is the low-risk appetite large European institutions such as pension funds have for VC as an asset class despite strong returns at EU level.

European Venture Capital is a deep and profitable Asset Class with 50 funds returning more than 20% Net IRR and 3rd quartile funds of recent vintages being in positive territory #UglyDuck19 @EIF_EU pic.twitter.com/Fx9tPRxMtN

— Nicolas Perard 🇪🇺 (@NicolasPerard) September 25, 2019

This differs from markets like the US where pension funds apportion patient capital to venture as an asset class and are comfortable with the risk and long-term returns it will provide over a 10-year lifecycle. Diversity in LP base is required to solve this as the bulk of LP funding in Europe still comes from governments, fund of funds, corporate investors, family offices and banks. Where there is less patient capital it also impacts valuations with more capital being available in the USA it drives the value of startups 3x greater than Europe.

2. Develop a clear industrial policy and framework for startups

The technology industry is growing 5x faster than the rest of the economy but still, in over 20 + years into the existence of the EU, there is no clear Industrial policy for startups or the digital sector. The single market only benefits goods manufacturers and the financial sector whilst the technology sector languishes country to country in Europe with challenging legal and regulatory frameworks.

Tribalism still exists in Europe and the reality is many of the powerful initiatives I’ve outlined exist at country level only to ensure entrepreneurs stay in-country which limits the EU’s ability to generate network effects and a coefficient of their investment in startups. European incorporation is non-existent, speedy access to financial infrastructure is elusive, Europe’s density of talent remains unleveraged and tax for startups is a political football.

Imagine a Europe where startup hubs in Europe are integrated through physical and digital infrastructure, talent, real cross-border commerce and a favorable regulatory environment designed for startups. This is the ultimate nirvana for Europe and the most impactful area where policy-makers can invest time. Glimpses of this are beginning to manifest across Europe in the private sphere with the ambitious project to link Estonia and Finland creating a super startup hub (albeit funded by a private Chinese investor) but this innovation is limited by the lack of a clear industrial charter from Brussels. More of this innovation is needed to think of Europe as an interconnected clusters of cities to ensure all hubs benefit from increasing returns to scale.

3. Be patient with exits and liquidity

In every booming startup ecosystem, there is usually a messy middle before generating escape velocity and I believe we are at the tail-end of this in Europe. Europe has had successful startup exits but examining the growing collection of European unicorns about to hit 100 in total Europe has not been through a real multi-year cycle of fund returning exits yet. As venture capital invested continues to grow and companies stay private longer the lack of liquidity for shareholders becomes problematic.

Venture capital is an asset class and whilst the goal is to enable great founders to build it is also to generate ROI. Investors need to realize gains, employees have bet their careers on a future outsized reward and the ecosystem needs the benefits of the first order and second-order effects an exit creates. China is the perfect storm for second-order effects post-exit as Chinese unicorns (BAT) start to expand horizontally, pay it forward and are now invested in 30% of Chinese startups.

Europe also has some cracks at Series B +, more and more US and Chinese investors are winning Series B deals and dominating later stage rounds at 100M+. This creates challenges for the average Series B company seeking to take their business to the next level when the US or Chinese don’t want them. This so-called Series B gap needs increased attention from VCs and the government to ensure there is a local path to resolution for founders.

Europe of course has later stage funds but the reality is that it is not as accessible as the early-stage market. Meanwhile, VCs like Balderton alleviate some of the pain with their liquidity fund on the secondaries market which is offering a path to liquidity for some shareholders. In the medium-term, this issue will disappear as Europe benefits from the end of this cycle and starts anew but in the interim, there is a delicate challenge to be solved in opening up more Series B funding to entrepreneurs.

4. Brexit should not be a barrier to building a homogenous tech market in Europe

In the short, to medium-term Brexit presents a new challenge for entrepreneurs building businesses in Europe, primarily due to the ambiguity surrounding the consequences as right now everything is conceptual. The UK will gradually untangle itself from EU policies and present a new regulatory framework for European businesses seeking to access the UK market. Moreover, the extent to which the UK can continue to exist as a benefactor of the Digital Single Market remains uncertain.

For tech-forward businesses the UK will become a ‘third country’ under Europe’s data protection policy forcing startups to create contract-based legal structures as opposed to the free flow of data, it benefited from in the EU. This will impact how entrepreneurs build and use products particularly in data-intensive industries where the UK is gaining dominance like deep-tech.

Whilst London contains the most software engineers of any city in Europe it is unknown how Brexit will impact this in practice when freedom of movement ceases. It will be more difficult for software engineers to access new visas and for high growth startups to draw on the EU talent pool, thus creating questions on whether London will attract new US companies setting up their European HQ which may now defer to Dublin or Berlin. Brexit also ensures UK startups lose the ‘country of origin’ principle which allows UK startups to base European compliance on UK law forcing entrepreneurs to now become compliant with the laws of each European country they operate in.

Notwithstanding all of this is conceptual at this point and needs to be negotiated between the UK and Europe. Long-term it is difficult to not be bullish on the UK as the leading tech economy in Europe. The economies of scale on talent and capital are vast.

The majority of funds at early stage and late-stage are domiciled in the UK serving European markets. Boris Johnson is proposing to remove the cap on tech visas leaving it in theory unlimited to talented software engineers and the government is offering up billions of patient capital for the tech sector. Much depends on how well the UK and EU handle the separation and the perception of the pound in global markets over the medium - long term but it is hard to see London lose its startup crown. This sentiment is also reinforced in Atomico’s State of European Tech Report with the majority of founders viewing London as the best place for launch a startup in Europe even with Brexit in play.

5. Incentivize talent with skin in the game

Stock options are central to attracting to talent to high-risk startup industries where much of the reward is placed on the future value of the company. Startups can usually not compete on the same salary incumbents offer and need to offer up ownership of the company to incoming employees and is a proven model in the UK.

The regulatory environment of Germany, Spain, Belgium, and other European countries is not favorable for domestic high-growth or foreign high-growth companies where the tax burden means offering up excessive comp plans so it reaches table-stakes for employees but many companies struggle with this.

"The financial winners of the German tech boom are mostly foreign investors. The employees only get the crumbs of the pie." @JohannesReck of @GetYourGuide does not mince his words on why stock option laws are failing German companies: https://t.co/f00bqHdgH5

— (((Maija Palmer))) (@maijapalmer) May 28, 2019

Europe needs to bring its incentives at European-level to parity with what is taking place in competing global hubs in order to ensure this does not become a self-fulfilling prophecy of Europe’s inability to compete.

6. Tap into Europe's unique talent capabilities

The US has been successful in building a culture of entrepreneurship around its universities with many of its Unicorns coming from Ivy League colleges. More recently China has also implemented the same approach aligning accelerators with key universities in Beijing. Innoway the government-backed startup village has incubated 3k startups raising greater than 1.3 billion USD in partnership with the top universities in Beijing. Europe lags behind in this regard; there is some progress and many European students have gone on to build successful startups particularly out of Oxford, Cambridge, and Berlin but the extent to which it is structurally enabled is minimal. More incentives and safety nets are required to ensure domain experts and computer science graduates can launch startups into a buoyant and well-funded European market.

7. Double down on building go-to-market muscle

Go-to-market is a double-edged sword in Europe as due to the fragmentation European companies quickly become experts at operationally launching in new territories but sometimes lack the sales and marketing polish of our peers across the Atlantic. This is an issue which consistently arises in many conversations I have with VCs and founders; the pay it forward mentality is growing stronger in Europe (but still weaker than Silicon Valley) so inexperienced founders are in a position where they can benefit from mature founders who have expanded globally but there is still a hangover in many ways around the cultural approach Europeans have to sales and marketing relying more heavily on product innovation than complimenting with a sales and marketing strategy. The build it and they will come mentality must evolve for European entrepreneurs to succeed.

What does the future hold

Ultimately I am very bullish on the European ecosystem. Let’s acknowledge that Europe is already delivering sector-leading businesses. It possesses all of the necessary ingredients and momentum to deliver world-beating startups and thriving diversity but the reality is a fragmented Europe is a weakened one when competing with large global regions.

The technology sector needs an open and favorable regulatory market that every country can drive, champion and benefit from in Europe. The funding challenges are real but acknowledging the speed at which this gap has been closing is promising. Lastly, Europe needs some exit fuel to push past this messy middle and enter the next cycle of high growth startups. Over the next decade, I believe the gap between Europe and its peers should begin to close somewhat but a real step-change improvement in delivering a single industrial policy for the startup and scaleup sector is required for Europe to hit this escape velocity.

If you're interested in chatting further reach out to me on Twitter I'd love to discuss.